Elbe Financial Solutions

About us

Elbe Financial Solutions

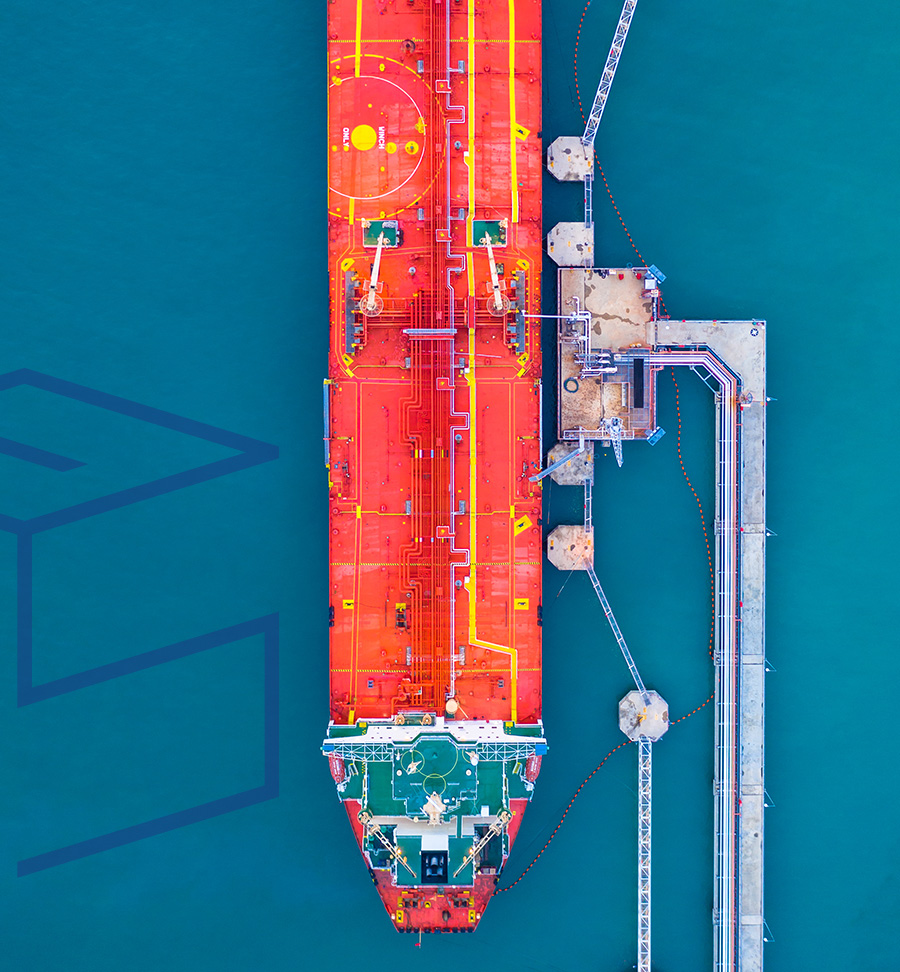

EFS is an alternative and independent investment firm focusing on maritime assets and global infrastructure with a strong Environmental, Social and Governance (ESG) overlay.

EFS has both a funding and an advisory capacity to meet the individual requirements of its clients.

Our Focus

Sustainable investing

The EFS team is fully dedicated to excellence in structuring, investing and managing its asset backed and equity investments.

Our goal is to support the transition towards a sustainable maritime and industrial economy by offering and structuring attractive tailor-made financial solutions.

ESMI Fund

Eurazeo Sustainable Maritime Infrastructure fund

EFS is the exclusive advisor of the ESMI fund, acting as shipping advisor and investment manager.

The objective of the ESMI fund is to finance the eco-transition and decarbonization of the maritime industry by offering tailor-made leasing solutions to shipowners, operators and maritime stakeholders

EFS is a Luxembourg and Hamburg based investment and advisory firm focusing exclusively on financial solutions for the shipping, infrastructure and energy sectors.

Its prime objective is to combine its in-depth industry and sustainability experience in these sectors with a strong set of financial engineering skills to provide investors with a unique one-stop-shop platform.

EFS has an extensive network, based on long-standing industry presence. To complement its financial asset management capabilities with physical asset management, EFS combines internal technical management resources and strong relationships with leading technical and commercial managers.

The management team is committed to excellence in structuring, investing and managing its asset backed and equity investments.

The objective is to support and accelerate the decarbonization and energy transition of the maritime industry by financing innovative and sustainable technologies applied to maritime assets, equipment and infrastructure.

Through financial lease and sale & leasback structures, the ESMI fund provides fast and reliable execution in line with best market practices, meeting companies’ financial needs and supporting growth.

Reach out for more information!

Sustainability

EFS has a long and consistent track record in managing assets with a strong focus on ESG. The team ensures very strong expertise in building sustainable portfolios that strongly integrate ESG research in the investment decision, process and strategy.

With tightening environmental regulations and awareness, the EFS team is fully committed to support the eco-transition of the capital-intensive maritime industry in order to reach the climate and pollution goals set by the Paris Agreements and the Annexe VI of the MARPOL Convention.

360° Finance

EFS provides efficient investment management for institutional investors, ship-owners and maritime professionals. The deal team has fundamental experience in origination, structuring and investment.

EFS is asset agnostic, covering all sustainable infrastructure segments, including shipping, offshore logistics, ports, energy related infrastructure and specialized niche markets.

EFS dedicated management team combines fundamental investment experience with more than 20 years of experience in project and asset management. Its expertise in chartering, technical and commercial management, operations, liquidity management and supervision of third party providers allow the proactive management of its asset-backed and equity investments.

Team

Seasoned investment and management team with large market networks and

expertise in shipping finance and active asset management.

The EFS team brings in-depth 360º shipping, infrastructure, sustainability and finance expertise, with more than 150 years of combined experience and the management of portfolios in excess of $10bn.

Its global and multicultural team, with local footprint across Europe, has strong experience in working together in a competitive environment and enjoys strong

relationships with strategic partners across the entire shipping and energy markets, including owners, traders, logistic companies, charterers, operators, banks, class societies and brokers.

Bernard Lambilliotte

Chairman

Prior to co-founding EFS, Bernard was CEO and Co-Founder of Ecofin Ltd., an independent investment management firm, founded in 1992, with focus on the global utility, infrastructure, alternative energy and environmental sectors, based in London. Between 2004 and 2014, Bernard also controlled 100 % of Ecofin Fund Management International which managed up to US$5.5bn of funds in various strategies.

Bernard has 35 years of experience in finance and investment management. His background in structuring investments and managing investment teams through complex investments in the sustainable energy and infrastructure sectors is directly contributing to EFS’s activity.

Bernard is a Civil Engineer and has an MBA from INSEAD Fontainebleau.

Jens Mahnke

Jens is Co-Founder of EFS and brings extensive industry network worldwide and fundamental shipping expertise. He has 29 years of experience in the maritime industry, including sale & purchase, chartering, shipping finance and asset management.

Jens started up his shipping career as Dry Cargo Chartering Broker at Skaarup Shipping in Hamburg and New York before becoming Chartering Manager in the bulker and tanker markets for 7 years at Frachtkontor Junge & Co.

At Nordcapital Group, Jens was Managing Partner overseeing a fleet of 130+ vessels under management. After that, as Managing Partner at König & Cie, he was responsible for all shipping activities and was involved in over 100 shipping transactions.

Prior co-founding EFS, he was CEO at Ernst Russ AG, a listed German group focusing on shipping and alternative asset classes such as fund-of-fund, infrastructure, real estate, and renewable energy for its issued fund vehicles (USD 5bn+).

At EFS, Jens has overall responsibility for shipping aspects, from origination, to monitoring and exiting the investments.

Dr. Dirk Lammerskötter

Dirk brings an intensive track record at the crossroads between financial structuring and shipping to EFS, with a 25 years professional career.

He started his career at the consultancy firm McKinsey & Company, before working in the corporate finance world. Moving into the maritime space, Dirk became Managing Director of HSH Corporate Finance, a subsidiary of HSH Nordbank (now Hamburg Commercial Bank). He later became Managing Director at the bank itself.

During his time at HSH, Dirk and his teams were responsible for many innovative ship finance (re-) structurings, and he is thus well-connected in the maritme space. In the last years, he worked as an independent consultant, helping some of Europe’s largest shipping groups in their financial set-ups.

As member of the supervisory board of “portfoliomanagement”, the wind down institution for shipping loans owned by the German states of Hamburg and Schleswig-Holstein, Dirk recently oversaw the successful sale of the remaining portfolio to an international financial consortium.

Dirk holds an M.Sc. (Econ) from the London School of Economics and a PhD from the University of Münster.

At EFS, Dirk is responsible for deal origination and structuring and corporate development.

Roel Haeseldonckx

Roel´s experience includes 25 years in debt and equity investments. He started his career as a Corporate Credit Officer focused on the underwriting of SME´s at the privately held Bank J. Van Breda & Co in Antwerp, Belgium. After that, he worked for 10 years at GE Capital in London, Paris, Amsterdam and Brussels, first as a Credit Manager at GE Capital´s European Equipment Finance (EEF) Benelux and Pan-European Team, were he was involved in 12 M&A projects and due diligences on European banks and Leasing companies. After that, he was M&A and Integrations Manager, as well as Business Development Manager at GE Working Capital Solutions (WCS). He became Commercial Leader and Member of the EMEA Management Team of GE WCS, with working capital responsibility for all GE´s industrials in EMEA.

For 4 years, he was an MD and Partner in the alternative lending Mezzanine Funds of DAM Capital (Dresdner Anschutz Mezzinvest) and its successor Belvall Capital. He worked as Senior Advisor in the investment team of Ecofin ltd, where he focused on debt strategies, and gained 7 years of corporate finance experience, including being a Partner at Clairfield International (Midcap Advisory).

Roel has a Cum Laude MSc Economics from Antwerp and an MBA from the University of Chicago. He was Erasmus Exchanged at the University of Jena, Germany.

At EFS, Roel is responsible for the whole investment process, from sourcing to closing. He is CFO and Managing Director for EFS Germany and Board Member at EFS Luxembourg.

Romain Uhl

Romain has a MSc in Business Administration from IESEG School of Business, France and a MSc in Shipping and Logistics from Southampton SOLENT University, UK.

Romain joined the investment team of EFS in 2017 and is engaged in the whole investment process, sourcing, structuring and executing transactions.

His past shipping experience includes 3 years at Ernst Russ AG and Ernst Russ Marine Advisors, covering alternative investments, structured shipping finance, active asset management of various portfolios and reporting.

At EFS, he is part of the investment team.